A Tabular Foundation Model For Smarter Insurance Decisions

TabPFN understands your underwriting, claims, and customer data; delivering faster, more accurate predictions. Make your data science workflows 90% faster.

High Impact Insurance Use Cases

Why Insurers Pick TabPFN

Fast To Value

Zero to prediction in seconds with zero-shot predictions and faster workflows.

Fine-Tuning

Optional fine-tuning on your proprietary data for domain adaptation and lift.

Synthetic Data

Privacy-preserving synthetic data generation to augment scarce or sensitive datasets.

Explainable And Fair

Feature-level impacts, partial dependence, example-based explanations to support fairness and compliance.

Explore 10 real-world insurance examples.

Context & Outcome

This dataset combines demographic, regional, and detailed vehicle specifications to predict whether a claim will occur for a motor policy. The sample includes tens of thousands of policies with diverse coverage contexts.

TabPFN generates strong claim risk scores without manual tuning, giving pricing teams more accurate exposure estimates and helping investigations focus on the riskiest cases to reduce leakage.

Task: Classification | Features: 43 | Rows: 58.6K (10K subsample) | Target: is_claim

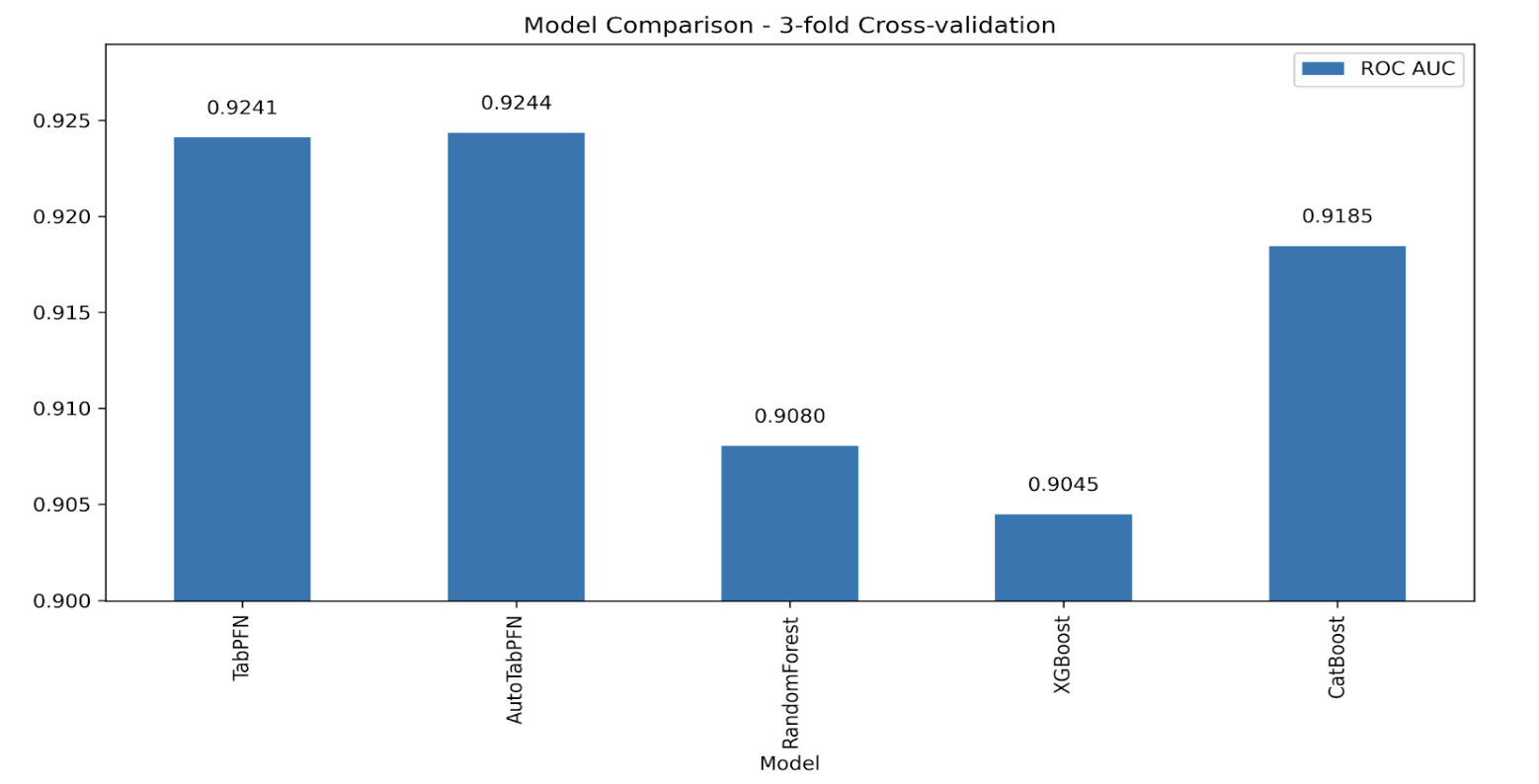

See TabPFN In Action

Flexible Plans

Contact Us

Talk To Our Sales Team